The end of the steel price decline might be near

Let’s get the bad news out of the way.

I usually start with steel prices and lead times. But I’d like to start with demand this time, because, Houston, we have a problem.

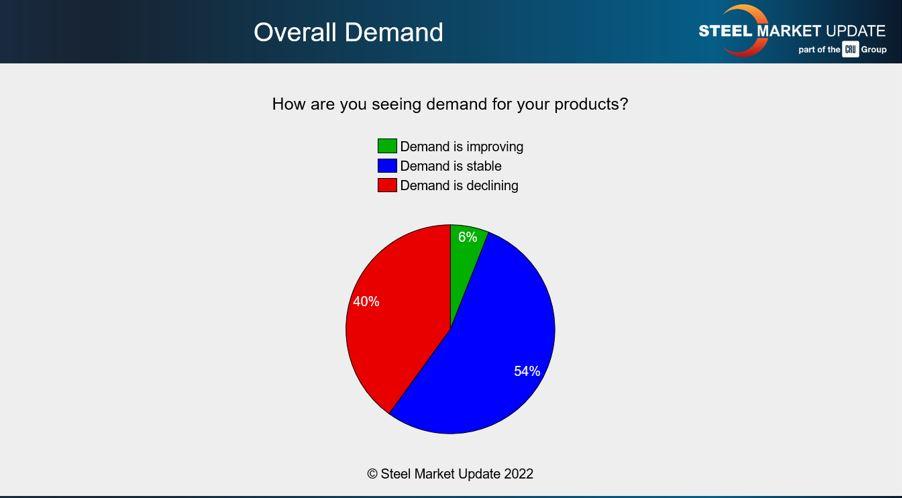

About 40% of people responding to the last survey from the Steel Market Update (SMU) reported decreasing demand. That’s the highest reading we’ve seen in our surveys since the outset of the pandemic in spring 2020.

I have been saying for the first six months of this year that stable demand was the sauce that made volatile steel prices palatable. That’s no longer the case. Only 54% report that demand is stable, and only a small minority says it is increasing (see Figure 1).

Also, we’ve done some initial calculations, and it looks like this feedback on demand might actually affect lead times. In other words, lead times are an advanced indicator of price moves, and people’s feelings about demand might be an advanced indicator of lead times.

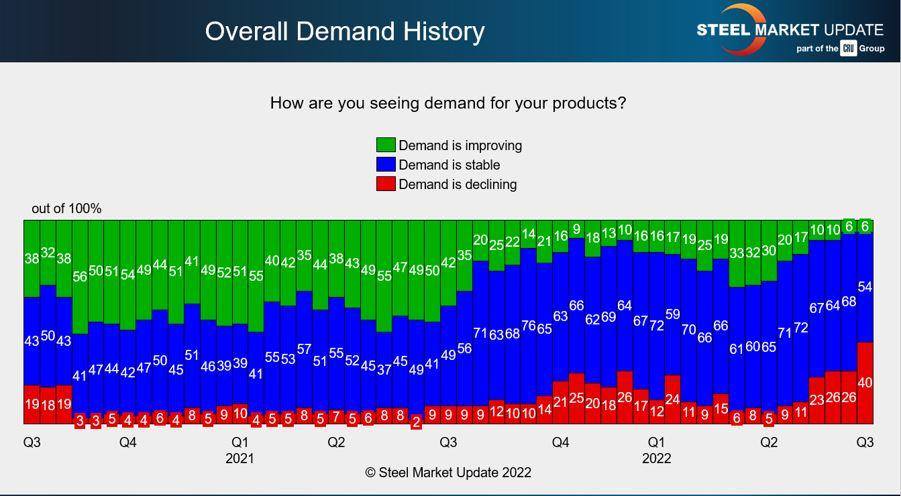

Why do I find that worrisome? Go back to summer 2020 (see Figure 2). We had prices in the $400s/ton then, but almost everyone was reporting that demand was stable or improving. Also, lead times were steadily extending even as prices continued to fall to a low of $440/ton in August of that year.

Based on those occurrences, you could already have concluded in late August or early September 2020 that things were going to change if you were tracking some of our non-price data closely. Demand was improving and lead times were extending, which meant that prices in the $400s/ton clearly were about to increase.

This summer, the reverse is true. Look at lead times (see Figure 3).

SMU’s hot-rolled lead times averaged four weeks in our last survey, the shortest they have been since mid-February. That’s also down from a 2022 peak of 5.8 weeks in April. Sources tell us that three weeks is becoming more and more common as mills struggle to fill order books.

We’ve seen similar trends for other products, even for plate—which has had relatively stable pricing compared to hot-rolled coil (HRC). The expectation is that prices will continue to move lower. As a result, respondents to our surveys keep adjusting their price forecasts lower from one survey to the next.

Figure 1. A survey of steel consumers reveals that demand for their products is decreasing. The hot manufacturing economy that has been a constant over the past couple of years seems to be cooling.

Port Chaos Easing?

It’s not just steel prices where we’re seeing cause for concern. Remember the chaos everyone experienced late last year and early this year with congested ports, the driver shortage, and the lack of warehouse space?

Some of those issues are still with us. Bringing in a cargo of galvanized steel from abroad? Good luck finding indoor warehouse space for that. Trying to send steel out to the West Coast via rail? Your carrier might ask you to find a truck instead.

But chaos at ports appears to be easing. For instance, the International Longshore & Warehouse Union, which represents 22,000 dock workers at 29 West Coast ports, put out a press release noting that union members at the ports of Los Angeles and Long Beach, the posterchild for port congestion, cleared more cargo in June than in any month in the port’s 115-year history.

Remember that chaos is not all bad. It means there is a lot of volume to move. Volume means money and economic activity.

A Sliver of a Silver Lining for the Mills

What is the silver lining here for the steel industry? It’s perhaps that the rate of steel price declines has slowed. Our HRC price was down $190/ton from mid-June to mid-July. That’s 28% less than the $265/ton drop from mid-May to mid-June.

Put another way, HRC prices hit a post-Russia-invasion-of-Ukraine peak of $1,480/ton in mid to late April. They were $910/ton in our last check of the market in mid-July. That’s a decline of $47.5/ton a week.

There is this notion that mills will draw a line in the sand at $800/ton or maybe $750/ton. Pick your number. Perhaps they will do that with idlings, reduced output, or extended maintenance outages. These are typical levers to pull to try to buy time. They can help to reduce supply, but they don’t do much to stimulate demand.

Still, I suggest keeping an eye not only on where and when prices will hit bottom but also on when lead times and prices might start rebounding. Why? Well, on a very basic level, you can’t continue to see price declines of about $50/ton per week for a whole lot longer before you’re at or near the cost of production.

Also, as I’ve written before, steel is famous for its recency bias. When prices are going up, we think they’ll go up forever, and when prices are falling, we tend to think better days will never come. The thing is, they do—even if it’s hard to predict when.

In the meantime, good luck out there, and I hope to see some of you soon at our Steel Summit in Atlanta.

Figure 2. Steel consumers have seen almost two years of strong demand for their products.

Source : thefabricator.com

If you want to import GOOD QUALITY Steel Coils from Vietnam, please contact us at:

– Email: datdq@namkimgroup.vn

– Mobile/Whatsapp/Wechat/Line/Viber: +84 973 765 730

– Website: https://steelvn.vn/

Galvanized steel sheet in coil I galvanized steel sheet suppliers I vietnam steel suppliers